Welcome To Roj Bash Kurdistan

Kurdistan Oil & Gas Development

Re: Kurdistan Oil & Gas Development

Oil Price

Kurdistan: Pipeline to ‘Independence’

As Kurdish authorities in Northern Iraq announce they will begin exporting crude oil by pipeline to Turkey as soon as the last link is finished in September, Gulf Keystone Petroleum launches a new exploration round that could reveal the best resource potential in the region.

UK-based Gulf Keystone Petroleum this week started operations at its Shaikan-7 exploration well in Iraqi Kurdistan, targeting reserves more than 2.5 miles underground.

Drilling for the company’s first deep well will take an estimated 9 months, and there is a lot of optimism for this play. Gulf Keystone thinks it holds up to 10.5 billion barrels of oil and is targeting 2015 for production of 150,000 barrels per day.

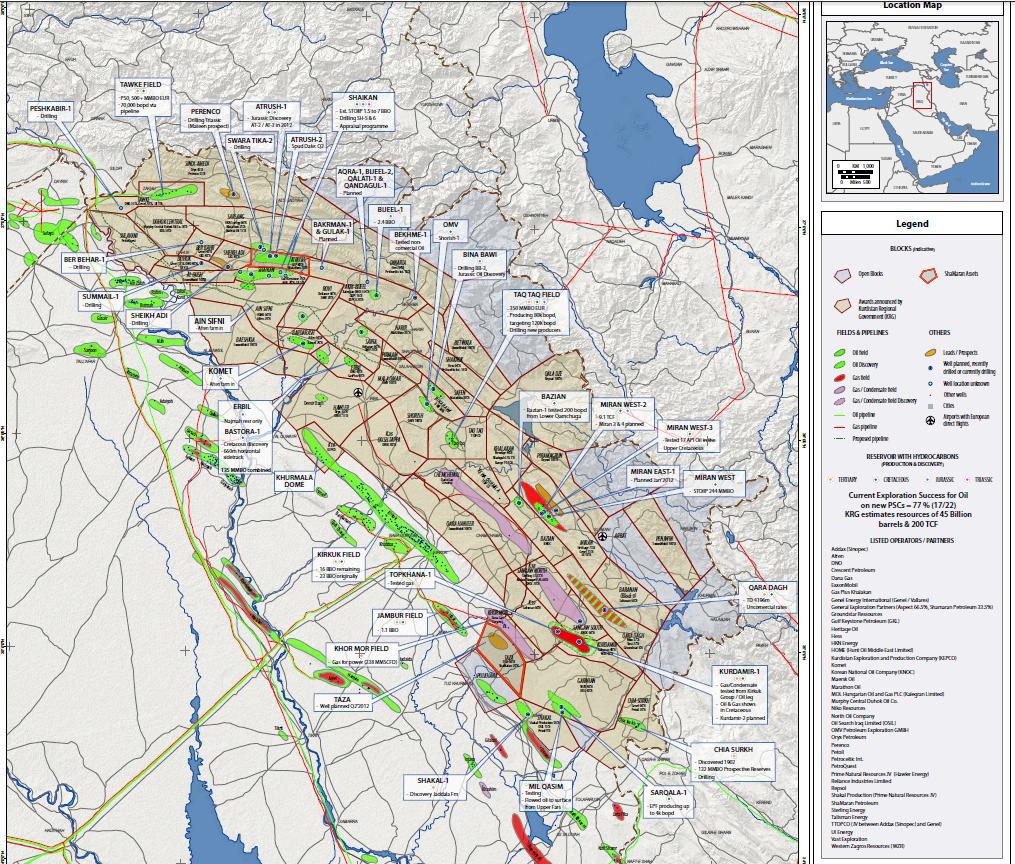

Kurdistan is already a hot venue, which just keeps getting hotter by the week, with amazing drilling success rates across the board. The territory governed by the Kurdistan Regional Government (KRG) has about 45 billion barrels of proven reserves.

What everyone is waiting on now is the pipeline to Turkey, which can bring Kurdish oil and gas to international markets, bypassing Baghdad.

The last pipeline link, slated to be completed by the end of September, will link up Kurdistan’s fields to the Turkish border at Fishkabour and will have a capacity of 1 million barrels a day by 2015. The country is close to having enough oil to fill that capacity, and more discoveries are coming on line all the time.

For now, the Kurds can only export to Turkey by truck, to the tune of about 30,000 barrels a day. In March this year, the Kurds sold their first crude on international markets, while previously they were trading crude with Turkey in return for refined products for use at home.

It was this first international sale that really re-sparked Baghdad’s ire. Baghdad views this as illegal oil and gas activity, but the Kurds—and foreign companies doing business in Northern Iraq—have shrugged off Baghdad’s multiple threats.

The Kurds have the advantage, even more so not that the rest of Iraq is engulfed in a sectarian conflict as it becomes the definitive second front in the war in Syria. Last week, Iraqi Prime Minister Nouri al-Maliki flew to Erbil, the capital of Iraqi Kurdistan, to hold high-level talks. This hasn’t happened since 2003, and it indicates that the talks were on the Kurds’ terms, as well as their terrain.

Will Baghdad be able to stop the Kurdish oil and gas momentum? Not at this point. Once the pipeline is up and running, the game is over and Baghdad doesn’t have the resources to turn it into a conflict.

By. Jen Alic of Oilprice.com

http://oilprice.com/Geopolitics/Middle- ... dence.html

Kurdistan: Pipeline to ‘Independence’

As Kurdish authorities in Northern Iraq announce they will begin exporting crude oil by pipeline to Turkey as soon as the last link is finished in September, Gulf Keystone Petroleum launches a new exploration round that could reveal the best resource potential in the region.

UK-based Gulf Keystone Petroleum this week started operations at its Shaikan-7 exploration well in Iraqi Kurdistan, targeting reserves more than 2.5 miles underground.

Drilling for the company’s first deep well will take an estimated 9 months, and there is a lot of optimism for this play. Gulf Keystone thinks it holds up to 10.5 billion barrels of oil and is targeting 2015 for production of 150,000 barrels per day.

Kurdistan is already a hot venue, which just keeps getting hotter by the week, with amazing drilling success rates across the board. The territory governed by the Kurdistan Regional Government (KRG) has about 45 billion barrels of proven reserves.

What everyone is waiting on now is the pipeline to Turkey, which can bring Kurdish oil and gas to international markets, bypassing Baghdad.

The last pipeline link, slated to be completed by the end of September, will link up Kurdistan’s fields to the Turkish border at Fishkabour and will have a capacity of 1 million barrels a day by 2015. The country is close to having enough oil to fill that capacity, and more discoveries are coming on line all the time.

For now, the Kurds can only export to Turkey by truck, to the tune of about 30,000 barrels a day. In March this year, the Kurds sold their first crude on international markets, while previously they were trading crude with Turkey in return for refined products for use at home.

It was this first international sale that really re-sparked Baghdad’s ire. Baghdad views this as illegal oil and gas activity, but the Kurds—and foreign companies doing business in Northern Iraq—have shrugged off Baghdad’s multiple threats.

The Kurds have the advantage, even more so not that the rest of Iraq is engulfed in a sectarian conflict as it becomes the definitive second front in the war in Syria. Last week, Iraqi Prime Minister Nouri al-Maliki flew to Erbil, the capital of Iraqi Kurdistan, to hold high-level talks. This hasn’t happened since 2003, and it indicates that the talks were on the Kurds’ terms, as well as their terrain.

Will Baghdad be able to stop the Kurdish oil and gas momentum? Not at this point. Once the pipeline is up and running, the game is over and Baghdad doesn’t have the resources to turn it into a conflict.

By. Jen Alic of Oilprice.com

http://oilprice.com/Geopolitics/Middle- ... dence.html

Good Thoughts Good Words Good Deeds

-

Anthea - Shaswar

- Donator

- Posts: 29496

- Images: 1155

- Joined: Thu Oct 18, 2012 2:13 pm

- Location: Sitting in front of computer

- Highscores: 3

- Arcade winning challenges: 6

- Has thanked: 6019 times

- Been thanked: 729 times

- Nationality: Kurd by heart

Kurdistan: Pipeline to ‘Independence’

As Kurdish authorities in Northern Iraq announce they will begin exporting crude oil by pipeline to Turkey as soon as the last link is finished in September, Gulf Keystone Petroleum launches a new exploration round that could reveal the best resource potential in the region.

UK-based Gulf Keystone Petroleum this week started operations at its Shaikan-7 exploration well in Iraqi Kurdistan, targeting reserves more than 2.5 miles underground.

Drilling for the company’s first deep well will take an estimated 9 months, and there is a lot of optimism for this play. Gulf Keystone thinks it holds up to 10.5 billion barrels of oil and is targeting 2015 for production of 150,000 barrels per day.

Kurdistan is already a hot venue, which just keeps getting hotter by the week, with amazing drilling success rates across the board. The territory governed by the Kurdistan Regional Government (KRG) has about 45 billion barrels of proven reserves.

What everyone is waiting on now is the pipeline to Turkey, which can bring Kurdish oil and gas to international markets, bypassing Baghdad.

The last pipeline link, slated to be completed by the end of September, will link up Kurdistan’s fields to the Turkish border at Fishkabour and will have a capacity of 1 million barrels a day by 2015. The country is close to having enough oil to fill that capacity, and more discoveries are coming on line all the time.

For now, the Kurds can only export to Turkey by truck, to the tune of about 30,000 barrels a day. In March this year, the Kurds sold their first crude on international markets, while previously they were trading crude with Turkey in return for refined products for use at home.

It was this first international sale that really re-sparked Baghdad’s ire. Baghdad views this as illegal oil and gas activity, but the Kurds—and foreign companies doing business in Northern Iraq—have shrugged off Baghdad’s multiple threats.

The Kurds have the advantage, even more so not that the rest of Iraq is engulfed in a sectarian conflict as it becomes the definitive second front in the war in Syria. Last week, Iraqi Prime Minister Nouri al-Maliki flew to Erbil, the capital of Iraqi Kurdistan, to hold high-level talks. This hasn’t happened since 2003, and it indicates that the talks were on the Kurds’ terms, as well as their terrain.

Will Baghdad be able to stop the Kurdish oil and gas momentum? Not at this point. Once the pipeline is up and running, the game is over and Baghdad doesn’t have the resources to turn it into a conflict.

UK-based Gulf Keystone Petroleum this week started operations at its Shaikan-7 exploration well in Iraqi Kurdistan, targeting reserves more than 2.5 miles underground.

Drilling for the company’s first deep well will take an estimated 9 months, and there is a lot of optimism for this play. Gulf Keystone thinks it holds up to 10.5 billion barrels of oil and is targeting 2015 for production of 150,000 barrels per day.

Kurdistan is already a hot venue, which just keeps getting hotter by the week, with amazing drilling success rates across the board. The territory governed by the Kurdistan Regional Government (KRG) has about 45 billion barrels of proven reserves.

What everyone is waiting on now is the pipeline to Turkey, which can bring Kurdish oil and gas to international markets, bypassing Baghdad.

The last pipeline link, slated to be completed by the end of September, will link up Kurdistan’s fields to the Turkish border at Fishkabour and will have a capacity of 1 million barrels a day by 2015. The country is close to having enough oil to fill that capacity, and more discoveries are coming on line all the time.

For now, the Kurds can only export to Turkey by truck, to the tune of about 30,000 barrels a day. In March this year, the Kurds sold their first crude on international markets, while previously they were trading crude with Turkey in return for refined products for use at home.

It was this first international sale that really re-sparked Baghdad’s ire. Baghdad views this as illegal oil and gas activity, but the Kurds—and foreign companies doing business in Northern Iraq—have shrugged off Baghdad’s multiple threats.

The Kurds have the advantage, even more so not that the rest of Iraq is engulfed in a sectarian conflict as it becomes the definitive second front in the war in Syria. Last week, Iraqi Prime Minister Nouri al-Maliki flew to Erbil, the capital of Iraqi Kurdistan, to hold high-level talks. This hasn’t happened since 2003, and it indicates that the talks were on the Kurds’ terms, as well as their terrain.

Will Baghdad be able to stop the Kurdish oil and gas momentum? Not at this point. Once the pipeline is up and running, the game is over and Baghdad doesn’t have the resources to turn it into a conflict.

-

Aslan - Tuti

- Posts: 1409

- Images: 81

- Joined: Mon Sep 10, 2012 5:11 am

- Highscores: 0

- Arcade winning challenges: 0

- Has thanked: 0 time

- Been thanked: 757 times

- Nationality: Prefer not to say

Gazprom considers more work in Iraq

ST. PETERSBURG, Russia, June 21 (UPI) -- Russian energy company Gazprom said it was interested in working further in the oil and natural gas sector in the Kurdish north of Iraq.

Gazprom Chairman Alexei Miller met in St. Petersburg with Massoud Barzani, president of the semiautonomous Kurdistan Regional Government.

Gazprom in a statement said both sides discussed the possibility of closer cooperation in the oil and natural gas sector.

"In particular, the parties discussed the progress with interaction in oil and gas field exploration, development and operation," the company said Thursday.

Gazprom Neft, the oil subsidiary of Gazprom, is in the process of exploration activity in the Garmian and Shakal blocks in the southern regions of the Kurdish territories.

Iraq has the fourth-largest oil reserves in the world. A 2012 assessment from the International Energy Agency said Iraqi oil production could expand exponentially over the coming years. The IEA said Iraq could eventually pass Russia as a major oil exporter.

Disputes over national oil laws, however, have cast a shadow over the Iraqi energy sector. The central government in Baghdad says it may be illegal for the Kurdish government to make its own deals, bypassing Baghdad.

Gazprom Chairman Alexei Miller met in St. Petersburg with Massoud Barzani, president of the semiautonomous Kurdistan Regional Government.

Gazprom in a statement said both sides discussed the possibility of closer cooperation in the oil and natural gas sector.

"In particular, the parties discussed the progress with interaction in oil and gas field exploration, development and operation," the company said Thursday.

Gazprom Neft, the oil subsidiary of Gazprom, is in the process of exploration activity in the Garmian and Shakal blocks in the southern regions of the Kurdish territories.

Iraq has the fourth-largest oil reserves in the world. A 2012 assessment from the International Energy Agency said Iraqi oil production could expand exponentially over the coming years. The IEA said Iraq could eventually pass Russia as a major oil exporter.

Disputes over national oil laws, however, have cast a shadow over the Iraqi energy sector. The central government in Baghdad says it may be illegal for the Kurdish government to make its own deals, bypassing Baghdad.

-

Aslan - Tuti

- Posts: 1409

- Images: 81

- Joined: Mon Sep 10, 2012 5:11 am

- Highscores: 0

- Arcade winning challenges: 0

- Has thanked: 0 time

- Been thanked: 757 times

- Nationality: Prefer not to say

Re: Kurdistan Oil & Gas Development

Chevron, Total expand Kurdish drilling

Iraq's Kurds have consolidated their growing energy sector with Chevron Corp. securing a third exploration block in the semiautonomous northern region that increasingly operates as a de facto independent state and France's Total buying a majority stake in another.

Iraq's Kurds have consolidated their growing energy sector with Chevron Corp. securing a third exploration block in the semiautonomous northern region and France's Total buying a majority stake in another.

These moves intensify the Kurds' challenge to Iraqi Prime Minister Nouri al-Maliki's problem-plagued coalition in Baghdad, heightening tension between government forces and the Kurdish peshmerga fighters -- those who face death -- on Kurdistan's southern boundary.

The rift between the federal government and the Kurdistan Regional Government in Erbil, the Kurdish capital, keeps widening. The latest deals with Chevron and Total make the prospect of a settlement ever more distant.

The Iraqi Kurds, part of a stateless people across the region numbering some 25 million, have long dreamed of an independent homeland and Baghdad fears the KRG's oil wealth will result in a unilateral breakaway that could trigger the break-up of the federal state.

The deepening dispute over who will control the world's fifth largest oil reserves, which could eventually rival Saudi Arabia's, is part of a long-running blood feud between the Kurds and Baghdad that may yet erupt into open war.

Such concerns have been heightened by the turmoil sweeping the entire Middle East and have dismayed the United States.

Chevron said it has completed acquisition of the Qara Dagh block southeast of Erbil, covering an area of 330 square miles.

Total says it bought an 80 percent stake in the Baranan block, with the remaining 20 percent held by the KRG. Total already has a 35 percent stake the Harir and Safen exploration zones.

The move by major oil companies into Kurdistan reflects a general disenchantment with Iraq's oil sector by Western oil majors who a few years ago expected a postwar bonanza.

The break was led by Exxon Mobil in October 2011 when it acquired six exploration blocks in Kurdistan, turning its back on a major stake in the $50 billion West Qurna 1 megafield in southern Iraq.

Russia's Gazprom Neft has also acquired blocks in Kurdistan in recent months.

Baghdad considers all these deals involving the KRG to be illegal and refuses to pay the oil companies operating in Kurdistan their share of export revenues.

The Kurds say they're owed more than $3.5 billion by Baghdad, and stopped exporting through the state pipelines in December.

Exxon, and later Total, broke with Baghdad because of frustration at Baghdad's bureaucratic snarls and endless delays in vital infrastructure projects, a sentiment shared with most international oil companies, which have dealings with Baghdad.

Another reason was the federal government's niggardly production-sharing terms. The KRG offered far more lucrative terms and less restrictive operating conditions.

Other companies have found Iraq tough going. Norway's Statoil pulled out altogether in 2012.

Unlike Exxon and Total, which stand to lose their stakes in major southern fields controlled by Baghdad, Chevron does not have any commitments in southern or central Iraq.

The KRG sits on an estimated 45 billion barrels of oil, about one-third of Iraq's proven reserves currently pegged at 150 billion barrels.

As these oil majors have moved into Kurdistan, Turkey has stepped in with plans for a pipeline from the Kurdish zone northward to export terminals on the Mediterranean, bypassing Baghdad's network.

Turkey, which has no energy resources, seeks to establish itself as the pivotal east-west energy hub as part of its drive to become the major power in the region.

The Iraqi Kurds are currently producing around 200,000 barrels per day and exporting around 65,000 bpd by trucking it to world markets through Turkey.

That's slotted to hit 250,000 bpd by year-end and 2 million bpd by 2019.

Baghdad last week unveiled new production targets that were significantly reduced from the blueprint it unveiled several years ago, and deemed wildly ambitious by the global energy industry.

But equally significantly, the new projections do not include production from Kurdistan, suggesting Baghdad may now believe a resolution of the oil dispute with the KRG is not possible.

The increased output foreseen by the Oil Ministry -- 4.5 million bpd by the end of 2014, 9 million bpd by 2020 -- will come largely from new oil produced by the southern Iraqi megafields.

Many in the industry say even that will be stretch.

http://www.upi.com/Business_News/Energy ... 371675824/

Good Thoughts Good Words Good Deeds

-

Anthea - Shaswar

- Donator

- Posts: 29496

- Images: 1155

- Joined: Thu Oct 18, 2012 2:13 pm

- Location: Sitting in front of computer

- Highscores: 3

- Arcade winning challenges: 6

- Has thanked: 6019 times

- Been thanked: 729 times

- Nationality: Kurd by heart

No intention to work in Kurdistan, Lokoil

company does not study any projects in the Kurdish region, because most of its work are in the southern part of the country.

Talking to Russia Today news agency, in Petersburg Forum, he added that "Qurna 2 oilfield is a unique one, because it is one of the biggest oil fields not yet utilized".

"We are able to choose a project in northern Iraq, but we prefer to concentrate on the south", he confirmed.

Talking to Russia Today news agency, in Petersburg Forum, he added that "Qurna 2 oilfield is a unique one, because it is one of the biggest oil fields not yet utilized".

"We are able to choose a project in northern Iraq, but we prefer to concentrate on the south", he confirmed.

-

Aslan - Tuti

- Posts: 1409

- Images: 81

- Joined: Mon Sep 10, 2012 5:11 am

- Highscores: 0

- Arcade winning challenges: 0

- Has thanked: 0 time

- Been thanked: 757 times

- Nationality: Prefer not to say

Re: Kurdistan Oil & Gas Development

Golf Times

Iraq excludes Kurds from ambitious 2014 oil production target

Reuters/London

Iraq aims to ramp up oil production by nearly 45% by the end of next year - without any input from its autonomous Kurdistan region - which suggests a lasting compromise in their long-running oil feud may be a way off.

Baghdad’s ambitious 4.5mn bpd target specifically excludes output from the northern Kurdish region, senior Iraqi officials said, and relies on new oil pumped from southern oilfields and higher flows from ones already producing.

Thamir Ghadhban, energy adviser to Iraq’s prime minister, said Baghdad had lost confidence in Kurdistan after the region stopped exporting oil through the federal pipeline system. “The 4.5mn bpd is based on the development of the resources within the 15 governorates excluding Kurdistan because of this issue,” Ghadhban, a former oil minister of Iraq, said at an energy conference in London last week.

Kurdistan says it is owed more than 4tn Iraqi dinars, or $3.5bn, by Baghdad to cover the costs accumulated by oil companies operating there, while the central government rejects those contracts as illegal.

The northern region used to ship crude through a pipeline network controlled by Baghdad, but exports via that channel stopped last December due to the payments row.

“We are not going to start again and make the same mistakes,” said Ashti Hawrami, natural resources minister of the Kurdistan Regional Government (KRG).

He confirmed that Kurdish oil is excluded from the 4.5mn bpd target, part of Iraq’s blueprint for long-term energy development - launched last week in Baghdad.

Hawrami said the strategy document - first seen by him on Tuesday - was “for the rest of Iraq, not northern Iraq”.

“I’m afraid we have never been consulted and we do not have any input into this document,” he said. “It excludes the Kurdistan region’s potential completely.”

The dispute between Baghdad and Kurdistan is part of wider disagreements over who controls the world’s fifth-largest oil reserves. Iraq says it alone has the exclusive right to export oil and sign deals, but Kurdistan says the constitution allows it to agree contracts and ship oil independently of Baghdad.

Iraqi Deputy Prime Minister Rosh Nuri al-Shawish said recent talks in the Kurdistan regional capital Arbil between the prime ministers of Iraq and Kurdistan had resulted in the formation of a high-level committee to focus on the oil and gas law and revenue-sharing legislation.

Reaching the high output level of 4.5mn bpd by the end of 2014 will be a real stretch for Opec’s No 2 producer, given myriad logistical and infrastructure bottlenecks and the disruption caused by the dispute between Baghdad and Kurdistan.

After stagnating for decades due to wars and sanctions, Iraq’s oil output and exports began to rise in earnest in 2010 after Baghdad secured service contracts with companies such as BP, Royal Dutch Shell, Eni and ExxonMobil.

Swift gains have raised Iraqi production by 600,000 bpd over two years to 3.15mn bpd. Iraq is due to reach 3.4mn bpd by the end of this year and export 2.9mn bpd - but that includes 250,000 bpd from Kurdistan.

For its part, the northern region is producing just under 200,000 bpd and exporting about 65,000 bpd by truck through Turkey to world markets. It has secured exploration contracts with the likes of Exxon, Chevron and Total.

Reaching Iraq’s 2014 target will require the start-up of the giant Majnoon oilfield, operated by Shell, and West Qurna-2, run by Russia’s Lukoil, along with Garraf and Badra - further north.

Ghadhban expects Majnoon to ramp up in July. By then, around 220,000 bpd of capacity should be installed, said Hans Nijkamp, Shell’s vice president and country chairman for Iraq.

The three production scenarios outlined in Iraq’s “Integrated National Energy Strategy” included output from the KRG, said Ghadhban.

Under a high-production scenario, production would reach 13.5mn bpd by 2017 and be maintained until 2023. A low-production scenario targets 6mn bpd by 2025.

Baghdad is expected to enforce the medium-production scenario, where output reaches 9mn bpd by 2020. That will require renegotiating service contracts with foreign firms.

Lukoil - at West Qurna-2 - and Italy’s Eni - at Zubair - have already agreed to reduce production targets. Other companies, such as BP, Exxon and Shell are in similar talks.

http://www.gulf-times.com/business/191/ ... ion-target

Iraq excludes Kurds from ambitious 2014 oil production target

Reuters/London

Iraq aims to ramp up oil production by nearly 45% by the end of next year - without any input from its autonomous Kurdistan region - which suggests a lasting compromise in their long-running oil feud may be a way off.

Baghdad’s ambitious 4.5mn bpd target specifically excludes output from the northern Kurdish region, senior Iraqi officials said, and relies on new oil pumped from southern oilfields and higher flows from ones already producing.

Thamir Ghadhban, energy adviser to Iraq’s prime minister, said Baghdad had lost confidence in Kurdistan after the region stopped exporting oil through the federal pipeline system. “The 4.5mn bpd is based on the development of the resources within the 15 governorates excluding Kurdistan because of this issue,” Ghadhban, a former oil minister of Iraq, said at an energy conference in London last week.

Kurdistan says it is owed more than 4tn Iraqi dinars, or $3.5bn, by Baghdad to cover the costs accumulated by oil companies operating there, while the central government rejects those contracts as illegal.

The northern region used to ship crude through a pipeline network controlled by Baghdad, but exports via that channel stopped last December due to the payments row.

“We are not going to start again and make the same mistakes,” said Ashti Hawrami, natural resources minister of the Kurdistan Regional Government (KRG).

He confirmed that Kurdish oil is excluded from the 4.5mn bpd target, part of Iraq’s blueprint for long-term energy development - launched last week in Baghdad.

Hawrami said the strategy document - first seen by him on Tuesday - was “for the rest of Iraq, not northern Iraq”.

“I’m afraid we have never been consulted and we do not have any input into this document,” he said. “It excludes the Kurdistan region’s potential completely.”

The dispute between Baghdad and Kurdistan is part of wider disagreements over who controls the world’s fifth-largest oil reserves. Iraq says it alone has the exclusive right to export oil and sign deals, but Kurdistan says the constitution allows it to agree contracts and ship oil independently of Baghdad.

Iraqi Deputy Prime Minister Rosh Nuri al-Shawish said recent talks in the Kurdistan regional capital Arbil between the prime ministers of Iraq and Kurdistan had resulted in the formation of a high-level committee to focus on the oil and gas law and revenue-sharing legislation.

Reaching the high output level of 4.5mn bpd by the end of 2014 will be a real stretch for Opec’s No 2 producer, given myriad logistical and infrastructure bottlenecks and the disruption caused by the dispute between Baghdad and Kurdistan.

After stagnating for decades due to wars and sanctions, Iraq’s oil output and exports began to rise in earnest in 2010 after Baghdad secured service contracts with companies such as BP, Royal Dutch Shell, Eni and ExxonMobil.

Swift gains have raised Iraqi production by 600,000 bpd over two years to 3.15mn bpd. Iraq is due to reach 3.4mn bpd by the end of this year and export 2.9mn bpd - but that includes 250,000 bpd from Kurdistan.

For its part, the northern region is producing just under 200,000 bpd and exporting about 65,000 bpd by truck through Turkey to world markets. It has secured exploration contracts with the likes of Exxon, Chevron and Total.

Reaching Iraq’s 2014 target will require the start-up of the giant Majnoon oilfield, operated by Shell, and West Qurna-2, run by Russia’s Lukoil, along with Garraf and Badra - further north.

Ghadhban expects Majnoon to ramp up in July. By then, around 220,000 bpd of capacity should be installed, said Hans Nijkamp, Shell’s vice president and country chairman for Iraq.

The three production scenarios outlined in Iraq’s “Integrated National Energy Strategy” included output from the KRG, said Ghadhban.

Under a high-production scenario, production would reach 13.5mn bpd by 2017 and be maintained until 2023. A low-production scenario targets 6mn bpd by 2025.

Baghdad is expected to enforce the medium-production scenario, where output reaches 9mn bpd by 2020. That will require renegotiating service contracts with foreign firms.

Lukoil - at West Qurna-2 - and Italy’s Eni - at Zubair - have already agreed to reduce production targets. Other companies, such as BP, Exxon and Shell are in similar talks.

http://www.gulf-times.com/business/191/ ... ion-target

Good Thoughts Good Words Good Deeds

-

Anthea - Shaswar

- Donator

- Posts: 29496

- Images: 1155

- Joined: Thu Oct 18, 2012 2:13 pm

- Location: Sitting in front of computer

- Highscores: 3

- Arcade winning challenges: 6

- Has thanked: 6019 times

- Been thanked: 729 times

- Nationality: Kurd by heart

President Barzani visits St. Petersburg

Kurdish Globe

Kurdish-Russian ties strengthened as President Barzani visits St. Petersburg

The President of the Kurdistan Region, Massoud Barzani, headed a high-ranking delegation that attended the Saint Petersburg International Economic Forum on June 20-22.

President Barzani with Russian Minister for Foreign Relations, Sergey Lavrov,

The President of the Kurdistan Region, Massoud Barzani, headed a high-ranking delegation that attended the Saint Petersburg International Economic Forum on June 20-22.

President Barzani was accompanied by the KRG?s Security Protection Advisor, Masrour Barzani, the Head of the Office of the President, Fuad Hussein, the Natural Resources Minister, Ashti Hawrami, the Head of the Department of Foreign Relations, Falah Mustafa, and the Chairman of the Board of Investment, Hersih Muharram, as well as a number of diplomats and advisors.

During the visit, President Barzani met with a number of senior political and economic figures attending the Forum, most importantly the Russian Minister for Foreign Relations, Sergey Lavrov, the Chairman of Gazprom Neft, Alexey Borisovich Miller, and the Vice-President of Chevron Corporation, Jay R. Pryor.

During the meeting between Barzani and Lavrov, the two politicians vowed to improve the political, social and economic relations between the two countries.

Minister Lavrov expressed his country's support for the activities of the Kurdistan-Russia Committee, as well as the Gazprom's business activities in the Kurdistan Region.

A while ago we met in Moscow and today we are meeting in St. Petersburg, Minister Lavrov told reporters after the meeting. Talking about relations between the Kurdistan Region and the central government of Iraq, the Kurdish President stressed positive developments in Baghdad-Erbil relations and reiterated that constitutional means are always the best solution when resolving issues.

Barzani also stated that the political and economic steps which Kurdistan is taking within ?our constitutional rights. During the Kurdish delegation?s meeting with Gazprom Neft, the company's CEO expressed his appreciation for the support the Kurdistan Region has extended to his company, which has facilitated easy and successful operations in the region.

Gazprom's Chairman, Alexey Miller, reiterated that his company will continue its operations in Kurdistan, stating that the company is planning to expand its activities into other aspects of infrastructural development in the Region.

In turn, President Barzani expressed his satisfaction that the company is playing such a key role in developing the oil sector in Kurdistan, and restated his government's full support for facilitating the company's business operations.

President Barzani also invited the Gazprom Board to Kurdistan to observe developments in the Region at first hand; the Chairman and Board of Directors accepted the invitation.

Gazprom Neft, a state-owned oil and gas company, is the largest company in Russia and the world's largest producer of natural gas. The company is currently exploring for oil in the Kurdistan Region under a Production Sharing Agreement (PSA) with the Kurdistan Regional Government (KRG).

During the meeting with Chevron, the company's Vice-President, Jay R. Pryor, briefed President Barzani and the Kurdish delegation about his company's activities in the Kurdistan Region and restated his company's full commitment to their PSA with the KRG. Chevron is an American oil giant with a PSA with the KRG for exploring and producing oil.

Following their Russian visit, the Kurdish President and his delegation will visit Romania to meet top-ranking officials for talks about political and economic ties.

Dr. Mahmoud Othman, a Kurdish member of the Iraqi Council of Representatives, told a local Kurdish news agency that President Barzani will visit Baghdad after his visits to Russia and Romania. According to Othman, Iraqi Prime Minister Nuri Maliki?s visit to the Kurdistan Region eased tensions between Baghdad and Erbil to an extent. President Barzani's visit will build on the goodwill created by Maliki?s visit, and feature talks on issues between the central and regional governments.

http://www.kurdishglobe.net/display-art ... 1266EA5758

Kurdish-Russian ties strengthened as President Barzani visits St. Petersburg

The President of the Kurdistan Region, Massoud Barzani, headed a high-ranking delegation that attended the Saint Petersburg International Economic Forum on June 20-22.

President Barzani with Russian Minister for Foreign Relations, Sergey Lavrov,

The President of the Kurdistan Region, Massoud Barzani, headed a high-ranking delegation that attended the Saint Petersburg International Economic Forum on June 20-22.

President Barzani was accompanied by the KRG?s Security Protection Advisor, Masrour Barzani, the Head of the Office of the President, Fuad Hussein, the Natural Resources Minister, Ashti Hawrami, the Head of the Department of Foreign Relations, Falah Mustafa, and the Chairman of the Board of Investment, Hersih Muharram, as well as a number of diplomats and advisors.

During the visit, President Barzani met with a number of senior political and economic figures attending the Forum, most importantly the Russian Minister for Foreign Relations, Sergey Lavrov, the Chairman of Gazprom Neft, Alexey Borisovich Miller, and the Vice-President of Chevron Corporation, Jay R. Pryor.

During the meeting between Barzani and Lavrov, the two politicians vowed to improve the political, social and economic relations between the two countries.

Minister Lavrov expressed his country's support for the activities of the Kurdistan-Russia Committee, as well as the Gazprom's business activities in the Kurdistan Region.

A while ago we met in Moscow and today we are meeting in St. Petersburg, Minister Lavrov told reporters after the meeting. Talking about relations between the Kurdistan Region and the central government of Iraq, the Kurdish President stressed positive developments in Baghdad-Erbil relations and reiterated that constitutional means are always the best solution when resolving issues.

Barzani also stated that the political and economic steps which Kurdistan is taking within ?our constitutional rights. During the Kurdish delegation?s meeting with Gazprom Neft, the company's CEO expressed his appreciation for the support the Kurdistan Region has extended to his company, which has facilitated easy and successful operations in the region.

Gazprom's Chairman, Alexey Miller, reiterated that his company will continue its operations in Kurdistan, stating that the company is planning to expand its activities into other aspects of infrastructural development in the Region.

In turn, President Barzani expressed his satisfaction that the company is playing such a key role in developing the oil sector in Kurdistan, and restated his government's full support for facilitating the company's business operations.

President Barzani also invited the Gazprom Board to Kurdistan to observe developments in the Region at first hand; the Chairman and Board of Directors accepted the invitation.

Gazprom Neft, a state-owned oil and gas company, is the largest company in Russia and the world's largest producer of natural gas. The company is currently exploring for oil in the Kurdistan Region under a Production Sharing Agreement (PSA) with the Kurdistan Regional Government (KRG).

During the meeting with Chevron, the company's Vice-President, Jay R. Pryor, briefed President Barzani and the Kurdish delegation about his company's activities in the Kurdistan Region and restated his company's full commitment to their PSA with the KRG. Chevron is an American oil giant with a PSA with the KRG for exploring and producing oil.

Following their Russian visit, the Kurdish President and his delegation will visit Romania to meet top-ranking officials for talks about political and economic ties.

Dr. Mahmoud Othman, a Kurdish member of the Iraqi Council of Representatives, told a local Kurdish news agency that President Barzani will visit Baghdad after his visits to Russia and Romania. According to Othman, Iraqi Prime Minister Nuri Maliki?s visit to the Kurdistan Region eased tensions between Baghdad and Erbil to an extent. President Barzani's visit will build on the goodwill created by Maliki?s visit, and feature talks on issues between the central and regional governments.

http://www.kurdishglobe.net/display-art ... 1266EA5758

Good Thoughts Good Words Good Deeds

-

Anthea - Shaswar

- Donator

- Posts: 29496

- Images: 1155

- Joined: Thu Oct 18, 2012 2:13 pm

- Location: Sitting in front of computer

- Highscores: 3

- Arcade winning challenges: 6

- Has thanked: 6019 times

- Been thanked: 729 times

- Nationality: Kurd by heart

Re: Kurdistan Oil & Gas Development

Oil Voice

Gulf Keystone announce that the Field Development Plan for the Shaikan field is now approved. The initial production capacity will start in the coming weeks, steadily increasing to 20,000 barrels oil per day (bopd) and then quickly progressing to 40,000 bopd on the completion of the second production facility.

Gulf Keystone, the independent oil and gas exploration and production company with operations in the Kurdistan Region of Iraq, is delighted to announce that the Field Development Plan for the Shaikan field, a world class commercial discovery, is now approved.

Todd F. Kozel, Chairman and CEO of Gulf Keystone, commented:

"This is an historic moment in the evolution of the Company. Gulf Keystone is now fully permitted to commence production from the Shaikan field and this represents a key milestone in the Company's growth. We have been a pioneer in the region from the outset and this milestone reconfirms our pioneering spirit and our desire to lead the upstream oil industry in Kurdistan"

"The initial production capacity will start in the coming weeks, steadily increasing to 20,000 barrels oil per day (bopd) and then quickly progressing to 40,000 bopd on the completion of the second production facility. This will increase to 150,000 bopd within 3 years and 250,000 bopd by 2018.

This is an enormous achievement by the GKP team who have worked so long and hard to achieve this goal and have forged such strong links within the Kurdistan Region, at all levels"

A spokesman of the Ministry of Natural Resources of the Kurdistan Region of Iraq said:

"Gulf Keystone has done outstanding work during the exploration phase, exceeding its minimum contractual requirements from two wells to seven wells, and making substantial progress in defining and delineating the Shaikan field."

Production from the Shaikan block will play a crucial role in helping the Kurdistan Region to achieve its overall oil export targets of one million barrels per day by the end of 2015, and two million barrels per day by the end of the decade."

The MNR spokesman added: "The Ministry of Natural Resources looks forward to working with Gulf Keystone, and its partner in the block Kalegran, to continue to achieve Shaikan's production targets."

The full Announcement from the Ministry of Natural Resources of the Kurdistan Region of Iraq is reproduced in full below:

PRESS RELEASE

FOR IMMEDIATE RELEASE

Kurdistan Region's Ministry of Natural Resources announces key milestone for the Shaikan oilfield

26 June 2013

Erbil, Kurdistan Region, Iraq - The Kurdistan Regional Government's Ministry of Natural Resources is pleased to announce that it has today approved the field development plan for the Shaikan block, operated by Gulf Keystone.

This is an important milestone in the development of one of the Kurdistan Regions' most important oilfields.

A Ministry of Natural Resources (MNR) spokesman said: "Gulf Keystone has done outstanding work during the exploration phase, exceeding its minimum contractual requirements from two wells to seven wells, and making substantial progress in defining and delineating the Shaikan field."

Production from the Shaikan block will play a crucial role in helping the Kurdistan Region to achieve its overall oil export targets of one million barrels per day by the end of 2015, and two million barrels per day by the end of the decade.

Shaikan's production capacity in the first phase , which will start in the coming weeks, will be 40,000 barrels per day (bpd), increasing to 150,000 bpd in the next three years and 250,000 bpd by 2018.

The MNR spokesman added: "The Ministry of Natural Resources looks forward to working with Gulf Keystone, and its partner in the block Kalegran, to continue to achieve Shaikan's production targets."

http://www.oilvoice.com/n/Gulf_Keystone ... 800f0.aspx

Gulf Keystone announce that the Field Development Plan for the Shaikan field is now approved. The initial production capacity will start in the coming weeks, steadily increasing to 20,000 barrels oil per day (bopd) and then quickly progressing to 40,000 bopd on the completion of the second production facility.

Gulf Keystone, the independent oil and gas exploration and production company with operations in the Kurdistan Region of Iraq, is delighted to announce that the Field Development Plan for the Shaikan field, a world class commercial discovery, is now approved.

Todd F. Kozel, Chairman and CEO of Gulf Keystone, commented:

"This is an historic moment in the evolution of the Company. Gulf Keystone is now fully permitted to commence production from the Shaikan field and this represents a key milestone in the Company's growth. We have been a pioneer in the region from the outset and this milestone reconfirms our pioneering spirit and our desire to lead the upstream oil industry in Kurdistan"

"The initial production capacity will start in the coming weeks, steadily increasing to 20,000 barrels oil per day (bopd) and then quickly progressing to 40,000 bopd on the completion of the second production facility. This will increase to 150,000 bopd within 3 years and 250,000 bopd by 2018.

This is an enormous achievement by the GKP team who have worked so long and hard to achieve this goal and have forged such strong links within the Kurdistan Region, at all levels"

A spokesman of the Ministry of Natural Resources of the Kurdistan Region of Iraq said:

"Gulf Keystone has done outstanding work during the exploration phase, exceeding its minimum contractual requirements from two wells to seven wells, and making substantial progress in defining and delineating the Shaikan field."

Production from the Shaikan block will play a crucial role in helping the Kurdistan Region to achieve its overall oil export targets of one million barrels per day by the end of 2015, and two million barrels per day by the end of the decade."

The MNR spokesman added: "The Ministry of Natural Resources looks forward to working with Gulf Keystone, and its partner in the block Kalegran, to continue to achieve Shaikan's production targets."

The full Announcement from the Ministry of Natural Resources of the Kurdistan Region of Iraq is reproduced in full below:

PRESS RELEASE

FOR IMMEDIATE RELEASE

Kurdistan Region's Ministry of Natural Resources announces key milestone for the Shaikan oilfield

26 June 2013

Erbil, Kurdistan Region, Iraq - The Kurdistan Regional Government's Ministry of Natural Resources is pleased to announce that it has today approved the field development plan for the Shaikan block, operated by Gulf Keystone.

This is an important milestone in the development of one of the Kurdistan Regions' most important oilfields.

A Ministry of Natural Resources (MNR) spokesman said: "Gulf Keystone has done outstanding work during the exploration phase, exceeding its minimum contractual requirements from two wells to seven wells, and making substantial progress in defining and delineating the Shaikan field."

Production from the Shaikan block will play a crucial role in helping the Kurdistan Region to achieve its overall oil export targets of one million barrels per day by the end of 2015, and two million barrels per day by the end of the decade.

Shaikan's production capacity in the first phase , which will start in the coming weeks, will be 40,000 barrels per day (bpd), increasing to 150,000 bpd in the next three years and 250,000 bpd by 2018.

The MNR spokesman added: "The Ministry of Natural Resources looks forward to working with Gulf Keystone, and its partner in the block Kalegran, to continue to achieve Shaikan's production targets."

http://www.oilvoice.com/n/Gulf_Keystone ... 800f0.aspx

Good Thoughts Good Words Good Deeds

-

Anthea - Shaswar

- Donator

- Posts: 29496

- Images: 1155

- Joined: Thu Oct 18, 2012 2:13 pm

- Location: Sitting in front of computer

- Highscores: 3

- Arcade winning challenges: 6

- Has thanked: 6019 times

- Been thanked: 729 times

- Nationality: Kurd by heart

List of downstream oil companies in Kurdistan

Source: Iraq Business News

Erbil Governorate has compiled and published a list of the top downstream oil companies in Kurdistan.

Unlike the upstream sector, Kurdistan’s refining industry is almost the exclusive preserve of locals, among them KAR Group, one of the region’s largest private companies, which operates Kalak Refinery.

According to the Financial Times:

“In addition to Erbil and the refineries at Baiji, central Iraq, Baghdad and Basrah, there are dozens of backyard, so-called “teapot”, refineries. Together they are capable of processing a total of about 790,000b/d of crude, according to the US Special Inspector General for Iraq Reconstruction.

“The surge in Kurdistan’s oil consumption is part of a broader trend within Iraq. The country has seen its oil demand rise to more than 700,000 b/d in 2011, up from just 450,000 b/d in 2003, as economic activity improves, according to estimates by the US Department of Energy.“

Top downstream oil companies and refineries in the Kurdistan Region:

UB Holding

In 2009, the company’s turnover was $1.2 billion, and this increased to approximately $1.5 billion in 2010. The company is involved in the upstream, midstream and downstream sectors. At present, UB Holding is one of the leading private sector companies in Iraq.

Baziyan refinery (Qaiwan Group)

Situated near Kurdistan’s second city of Suleimaniya, Baziyan refinery was taken over in 2009 by a local trading company, Qaiwan. It is being upgraded by Ventech to increase its capacity to 34,000 b/d.

Kalak Refinery (Kar Group)

Kalak is the largest refinery in Kurdistan. It now has refining capacity of 100,000 barrels of oil a day, a figure that is set to rise sharply in the coming years. Kalak is expanding fast. Kalak supplies 75 per cent of local demand for products such as high-octane gasoline.

http://www.iranoilgas.com/news/details2 ... estrict=no

Anthea: Learn something new every day on here - I had no idea there was such a difference between downstream and upstream oil companies

I sincerely hope that the Kurdistan government put more money into Kurdistan’s downstream refining industry and supports local industry more

Good Thoughts Good Words Good Deeds

-

Anthea - Shaswar

- Donator

- Posts: 29496

- Images: 1155

- Joined: Thu Oct 18, 2012 2:13 pm

- Location: Sitting in front of computer

- Highscores: 3

- Arcade winning challenges: 6

- Has thanked: 6019 times

- Been thanked: 729 times

- Nationality: Kurd by heart

List of oil companies in Kurdistan

List of oil companies in Kurdistan

Erbil Governorate has compiled and published a list of the top oil companies in Kurdistan.

Listing them by country:

USA

• Exxon Mobil, Chevron, Aspect Energy, Marathon Oil Corporation, Hillwood International Energy, Hunt Oil, Prime Oil, Murphy Oil, Hess Corporation, HKN Energy, Viking International

Canada

• Forbes and Manhattan, Western Zagros Resources, Talisman Energy Inc, NIKO Resources, Ground Star, Shamaran

South Korea

• Korea National Oil Company (KNOC)

Turkey

• Genel Energy, Petoil, Dogan

Britain

• Gulf Keystone Petroleum, Sterling Energy, Heritage Oil

Anglo-French

• Perenco

UAE

• TAQA, Dana Petroleum

France

• Total

Austria

• OMV

China

• China acquired a significant presence in Iraqi Kurdistan after Sinopec Group bought Addax Petroleum in 2009.

Hungary

• MOL

India

• Reliance Industries

Papua New Guinea

• Oil Search

Russia

• Norbest, Gazprom Neft

Norway

• DNO

Iraq

• Oil Search (Iraq) Limited, Kar Group, Qaiwan Group

Spain

• Repsol

Independent

• AFREN

http://www.iranoilgas.com/news/details2 ... estrict=no

Good Thoughts Good Words Good Deeds

-

Anthea - Shaswar

- Donator

- Posts: 29496

- Images: 1155

- Joined: Thu Oct 18, 2012 2:13 pm

- Location: Sitting in front of computer

- Highscores: 3

- Arcade winning challenges: 6

- Has thanked: 6019 times

- Been thanked: 729 times

- Nationality: Kurd by heart

List of oil distribution, service companies in Kurdistan

Erbil Governorate has compiled and published a list of the top oil distribution companies in Kurdistan:

Qaiwan Group

A diversified conglomerate based in Suleimaniyah with activities in construction (Qaiwan Towers, Qaiwan City, Sulaimaniyah Heights), energy (Baziyan Refinery, Petrol Stations, Oil Trading), retail and hospitality (Rotana Hotel Suleimaniyah, Qaiwan Hotel).

UB Holding

In 2009, the company’s turnover was $1.2 billion, and this increased to approximately $1.5 billion in 2010. The company is involved in the upstream, midstream and downstream sectors. At present, UB Holding is one of the leading private sector companies in Iraq.

Sher Oil (Hewa Group)

Top Oil & Gas Sector Service | Design | Engineering & Construction Companies Kurdistan

It also list the top oil and gas management services companies as:

• RPS Energy

• Kar Group

• Tenaris

• Zagros Oil & Gas

http://www.iranoilgas.com/news/details2 ... estrict=no

Good Thoughts Good Words Good Deeds

-

Anthea - Shaswar

- Donator

- Posts: 29496

- Images: 1155

- Joined: Thu Oct 18, 2012 2:13 pm

- Location: Sitting in front of computer

- Highscores: 3

- Arcade winning challenges: 6

- Has thanked: 6019 times

- Been thanked: 729 times

- Nationality: Kurd by heart

Re: List of oil companies in Kurdistan

Anthea wrote:Look at this list of countries involved in Kurdistan Oil - it is absolutely wonderful that Kurdistan is working with such a wide variety of countries and learning from their expertise - and it goes to show the International status Kurdistan now holds

USA

Canada

South Korea

Turkey

Britain

Anglo-French

UAE

France

Austria

China

Hungary

India

Papua New Guinea

Russia

Norway

Iraq

Spain

Independent

http://www.iranoilgas.com/news/details2 ... estrict=no

Good Thoughts Good Words Good Deeds

-

Anthea - Shaswar

- Donator

- Posts: 29496

- Images: 1155

- Joined: Thu Oct 18, 2012 2:13 pm

- Location: Sitting in front of computer

- Highscores: 3

- Arcade winning challenges: 6

- Has thanked: 6019 times

- Been thanked: 729 times

- Nationality: Kurd by heart

Gulf Keystone to pump 40,000 bpd Kurdish oil in weeks

Reuters

Gulf Keystone Petroleum will produce 40,000 barrels of oil per day (bpd) within the coming weeks after the Iraqi Kurdistan-focused explorer's field development plan was approved, the region's energy ministry said on Wednesday.

Discovered in 2009, the Shaikan field is Gulf Keystone's prize asset, from which it aims to produce as much as 150,000 bpd in the next three years and 250,000 bpd by 2018.

Production from the block will help the Kurdistan region reach its overall oil export targets of one million barrels per day by the end of 2015, and two million barrels per day by the end of the decade.

Gulf Keystone operates Shaikan, in which Kalegran Ltd, a subsidiary of Hungarian oil and gas group MOL, has a stake, as well as Texas Keystone Inc.

In recent months, investor focus has been less on Gulf Keystone's activities in Kurdistan than its ownership of some of those assets, which the company has been defending in a London court battle after it was sued.

Kurdish crude is also the subject of disputes with the Iraqi central government, which rejects contracts signed by the autonomous region as illegal and has withheld payment to companies operating there.

Kurdistan says its right to grant contracts to foreign companies is enshrined in the Iraqi constitution, which was drawn up following the 2003 invasion that ousted Sunni dictator Saddam Hussein.

The Kurds have since passed their own oil and gas law, whilst disagreements among Iraq's Sunni, Shi'ite and Kurdish factions in the national power-sharing government have held up long-awaited hydrocarbons legislation.

http://www.reuters.com/article/2013/06/ ... KK20130626

Gulf Keystone Petroleum will produce 40,000 barrels of oil per day (bpd) within the coming weeks after the Iraqi Kurdistan-focused explorer's field development plan was approved, the region's energy ministry said on Wednesday.

Discovered in 2009, the Shaikan field is Gulf Keystone's prize asset, from which it aims to produce as much as 150,000 bpd in the next three years and 250,000 bpd by 2018.

Production from the block will help the Kurdistan region reach its overall oil export targets of one million barrels per day by the end of 2015, and two million barrels per day by the end of the decade.

Gulf Keystone operates Shaikan, in which Kalegran Ltd, a subsidiary of Hungarian oil and gas group MOL, has a stake, as well as Texas Keystone Inc.

In recent months, investor focus has been less on Gulf Keystone's activities in Kurdistan than its ownership of some of those assets, which the company has been defending in a London court battle after it was sued.

Kurdish crude is also the subject of disputes with the Iraqi central government, which rejects contracts signed by the autonomous region as illegal and has withheld payment to companies operating there.

Kurdistan says its right to grant contracts to foreign companies is enshrined in the Iraqi constitution, which was drawn up following the 2003 invasion that ousted Sunni dictator Saddam Hussein.

The Kurds have since passed their own oil and gas law, whilst disagreements among Iraq's Sunni, Shi'ite and Kurdish factions in the national power-sharing government have held up long-awaited hydrocarbons legislation.

http://www.reuters.com/article/2013/06/ ... KK20130626

Good Thoughts Good Words Good Deeds

-

Anthea - Shaswar

- Donator

- Posts: 29496

- Images: 1155

- Joined: Thu Oct 18, 2012 2:13 pm

- Location: Sitting in front of computer

- Highscores: 3

- Arcade winning challenges: 6

- Has thanked: 6019 times

- Been thanked: 729 times

- Nationality: Kurd by heart

A Grossly Undervalued Kurdish Oil Play

Seeking Alpha

DNO International: A Grossly Undervalued Kurdish Oil Play. DNO International (DTNOF.PK) is an independent exploration and production company from Norway with a major presence in the Middle East and North Africa region.

DNO's stock price has increased by 46% in the last one year. However, the stock is still grossly undervalued and certain de-risking triggers can result in another 100% upside from current levels. This investment note discusses the current valuation, earnings quality, growth prospects and the de-risking potential over the next one year.

DNO Is Grossly Undervalued

DNO's 2P reserves have grown from 151 mmboe in 2005 to 520 mmboe in 2012. During the same period, the company's EV per 2P reserves ($) has declined from $26 to $3.2. This metric gives the level of undervaluation with the EV/boe declining even as operational progress has been robust.

In terms of PE valuation, the stock is currently trading at a PE of 11.1 and a forward PE of 7.7. Also, considering a mean 2014 growth estimate of 28.7%, the stock is trading at a current PEG ratio of 0.39, which again suggests gross undervaluation considering the potential growth.

Tawke Field Development Has Been Excellent

DNO is the first foreign company to drill for oil in Iraq after the US-led invasion in 2003. DNO discovered the Tawke field in the Kurdistan region of Iraq in 2006. The Tawke field is one of the largest oil fields in the Iraq region of Kurdistan. DNO is the operator of Tawke with a 55% stake. The other stakeholders are Genel Energy Plc, which has a 25% stake and the Kurdistan Regional Government with the remaining 20%.

A separate discussion on this field is important as 90% of the 2P reserves of 520 mmboe are from the Tawke field. The asset can therefore be a future money spinner for DNO. Kurdistan specifically has the potential to be one of the leading contributors to global oil supplies by the end of the decade according to a report by the Financial Times.

Coming to the operational progress in the Tawke field, in April 2013, DNO announced extensive testing of the Tawke-17 exploration well including positive observations in the Jurassic and Triassic intervals of the Tawke field. In May 2013, DNO announced that oil production from the Tawke field in the Kurdistan Region of Iraq has averaged over 100,000 barrels a day, which was the first delivery milestone for the company.

According to the June 2013 press release -

The reason for highlighting the operational development is to focus on the excellent progress on the company's money spinner. The biggest positive comes from the Tawke-17 well, which tested for 1500 boe/day and de-risks gross resources of nearly 200-300 mmboe. At the same time, the Tawke-20 well has reported 8000 boe/day, which further helps DNO achieve its near-term target of production capacity (200,000 boe per day).

Besides the current positive developments in the Tawke field, the stock upside can be triggered by further drilling and appraisal in 2013 for Kurdistan and other regions. The chart below outlines the drilling and the appraisal outlook for the remainder of 2013.

In total, DNO will be drilling 15-20 wells in 2013 with a focus on appraisal and infill drilling at existing fields. The drilling program should allow DNO to establish production from Benenan, Summail and Saleh relatively soon. Therefore, the positive new inflow (as witnessed in the last three months) should continue for DNO resulting in upside stock price action. Other than meeting the current targets, any upside resource potential in the Tawke field can also trigger upside in the stock. An indication of a potential upside in resources is evident from the management's optimism on a potential further enhancement of the current target of 200,000 barrels a day of production capacity by 2015. According to DNO, an independent study made in early 2012 estimated the ultimate gross recoverable volumes of the Tawke reserves to be 771 million barrels of oil.

Improving Earnings Quality And Strong Credit Metrics

Health cash conversion is a key indicator of earnings quality and DNO's cash conversion has been robust in the recent past. This discussion assumes importance as it underscores the point that a lower share price is due to other macro factors (to be discussed later) and is not related to the company's financial health or earnings quality. DNO's cash conversion factor (operating cash flow to EBITDA) has improved to 78% in FY12 from 49% in FY11. Even for the first quarter of 2013, the cash conversion factor was at a robust 136%. DNO has also been generating positive free cash flow in the last three years with FY12 free cash flow as a percentage of sales being 15.3%. In terms of leverage, DNO has a debt to equity of 0.3 and a debt to EBITDA of 0.6 as of FY12. Further, EBITDA interest coverage of 14.7 for the same period gives DNO sufficient financial flexibility for future capital expenditure programs.

Why Is The Stock Price Depressed?

Given the positive investment rationale, it is surprising to see the stock trading at cheap valuations discussed above. The point that is clear is that the valuations are not depressed because of poor earnings or sluggish operational progress.

The depressed valuation primarily comes from the absence of a final export agreement with the local government coupled with the issue of the establishment of a credible payment mechanism. Oil exports from the Tawke field in the Kurdistan region of Iraq were halted in December 2012, which resulted in no export revenue for the first quarter of 2013. Export revenues from the Tawke field were 651 million Norwegian Kronor during 4Q12.

DNO is currently selling oil in the local market, which is at a considerable discount to international oil prices. Markets are therefore discounting the current production output and future production outlook at significantly lower prices and this is impacting valuations.

The resumption of exports to international markets and a credit payment mechanism will serve as the biggest upside trigger for DNO in the future.

Probability of Payment And Export Issue Resolution

There is a high probability of resolution of the payment issue and the allowance of exports from the Kurdish region in the foreseeable future. The primary reason is the need for funding infrastructure in a war torn country. The first sign of resolution of the issue is evident from the tentative deal by Iraq and the Kurds on payment to oil companies. According to the report by Zawya -

Besides the current issue and its movement towards a probable resolution, the presence of major oil companies in Kurdistan also points to the fact that the government is willing to allow companies to operate and export from the region. Further, exploration companies are also confident of a resolution and are therefore investing in the region.

As of December 2012, Marathon Oil (MRO) held approximately 215,000 net acres on a working interest basis in the Kurdistan Region of Iraq. In the same region, Total SA (TOT) also has 35% working interest in 2 oil blocks, in which Marathon has a stake besides the Kurdish government.

Most recently, Chevron (CVX) also signed an exploration deal with the Kurdish government to expand its oil exploration territory in the northern self-rule region.

Exxon Mobil (XOM) is also working on a gas project in Kurdistan along with the Turkey government. As Turkey has a high energy cost due to purchase of natural gas from Russia, Iran and Azerbaijan, a deal with the neighboring Kurdish government will prove more beneficial and lower the energy cost.

As mentioned earlier, major oil companies would not be willing to invest without some assurance related to payments and exports. A Bloomberg report on June 19, 2013 is an indication of the developments in the region related to the export of oil. According to the report -

These developments and the increasing interest of the oil majors to operate in the Kurdistan region is an indication of the point that a resolution is entirely on the cards related to exports and payments to oil companies. Going forward, a firm statement from the government can trigger significant stock price upside for DNO as the stock discounts gains from higher export prices.

I must mention here that the Tawke field is strategically located and will be one of the prime beneficiaries of any pipeline or export agreement with Turkey discussed above.

DNO Can Also Be A Potential Acquisition Target

Considering the way oil majors are looking for entry into the Kurdish region, DNO can also be a potential acquisition candidate at current valuations. DNO's assets are interesting from a M&A perspective and the Tawke asset can also be a standalone acquisition target. Any attractive acquisition bid can also trigger a major upside in the stock.

Risk Factors

The biggest risk factor for DNO is the non-resolution of the payment and export issue. However, the current stock price is depressed considering the scenario of oil sales only to local markets. It is therefore very unlikely that there will be any major downside risk from current levels.

Conclusion

DNO, with a 55% stake in the Tawke prized asset, is a grossly undervalued stock due to political issues prevailing in the region. As discussed, a resolution is very likely in the foreseeable future and DNO can see some significant stock price action. Considering a forward PE of 7.7 and a PEG ratio of 0.39, a 100% upside is very likely in the event of a resolution of the payment and export issue. The planned 2014-15 capacity of 200,000 boe per day of exports can completely change the cash flow dynamics and trigger a meaningful upside in the stock. Investors can therefore consider exposure to the multibagger at current levels.

Source: DNO International: A Grossly Undervalued Kurdish Oil Play

DNO International: A Grossly Undervalued Kurdish Oil Play. DNO International (DTNOF.PK) is an independent exploration and production company from Norway with a major presence in the Middle East and North Africa region.

DNO's stock price has increased by 46% in the last one year. However, the stock is still grossly undervalued and certain de-risking triggers can result in another 100% upside from current levels. This investment note discusses the current valuation, earnings quality, growth prospects and the de-risking potential over the next one year.

DNO Is Grossly Undervalued

DNO's 2P reserves have grown from 151 mmboe in 2005 to 520 mmboe in 2012. During the same period, the company's EV per 2P reserves ($) has declined from $26 to $3.2. This metric gives the level of undervaluation with the EV/boe declining even as operational progress has been robust.

In terms of PE valuation, the stock is currently trading at a PE of 11.1 and a forward PE of 7.7. Also, considering a mean 2014 growth estimate of 28.7%, the stock is trading at a current PEG ratio of 0.39, which again suggests gross undervaluation considering the potential growth.

Tawke Field Development Has Been Excellent

DNO is the first foreign company to drill for oil in Iraq after the US-led invasion in 2003. DNO discovered the Tawke field in the Kurdistan region of Iraq in 2006. The Tawke field is one of the largest oil fields in the Iraq region of Kurdistan. DNO is the operator of Tawke with a 55% stake. The other stakeholders are Genel Energy Plc, which has a 25% stake and the Kurdistan Regional Government with the remaining 20%.

A separate discussion on this field is important as 90% of the 2P reserves of 520 mmboe are from the Tawke field. The asset can therefore be a future money spinner for DNO. Kurdistan specifically has the potential to be one of the leading contributors to global oil supplies by the end of the decade according to a report by the Financial Times.

Coming to the operational progress in the Tawke field, in April 2013, DNO announced extensive testing of the Tawke-17 exploration well including positive observations in the Jurassic and Triassic intervals of the Tawke field. In May 2013, DNO announced that oil production from the Tawke field in the Kurdistan Region of Iraq has averaged over 100,000 barrels a day, which was the first delivery milestone for the company.

According to the June 2013 press release -

Deep Tawke-17 well tested 1,500 barrels a day of 26-28 degree API crude oil from an Upper Jurassic reservoir underlying the Tawke field in the Kurdistan Region of Iraq. Separately, the Tawke-20 well, the Company's first horizontal well in the Tawke field, has flowed an average of 8,000 barrels a day from each of the first four of ten fractured corridors penetrated by the well. Testing continues on both wells...Drilling of a second Tawke horizontal well continues on schedule. "If this second well, Tawke-23, demonstrates the significant deliverability uptick we are now seeing in Tawke-20, we will go back to the drawing board and consider further enhancements to our current target of 200,000 barrels a day of production capacity by 2015," Mr. Mossavar-Rahmani said.

The reason for highlighting the operational development is to focus on the excellent progress on the company's money spinner. The biggest positive comes from the Tawke-17 well, which tested for 1500 boe/day and de-risks gross resources of nearly 200-300 mmboe. At the same time, the Tawke-20 well has reported 8000 boe/day, which further helps DNO achieve its near-term target of production capacity (200,000 boe per day).

Besides the current positive developments in the Tawke field, the stock upside can be triggered by further drilling and appraisal in 2013 for Kurdistan and other regions. The chart below outlines the drilling and the appraisal outlook for the remainder of 2013.

In total, DNO will be drilling 15-20 wells in 2013 with a focus on appraisal and infill drilling at existing fields. The drilling program should allow DNO to establish production from Benenan, Summail and Saleh relatively soon. Therefore, the positive new inflow (as witnessed in the last three months) should continue for DNO resulting in upside stock price action. Other than meeting the current targets, any upside resource potential in the Tawke field can also trigger upside in the stock. An indication of a potential upside in resources is evident from the management's optimism on a potential further enhancement of the current target of 200,000 barrels a day of production capacity by 2015. According to DNO, an independent study made in early 2012 estimated the ultimate gross recoverable volumes of the Tawke reserves to be 771 million barrels of oil.

Improving Earnings Quality And Strong Credit Metrics

Health cash conversion is a key indicator of earnings quality and DNO's cash conversion has been robust in the recent past. This discussion assumes importance as it underscores the point that a lower share price is due to other macro factors (to be discussed later) and is not related to the company's financial health or earnings quality. DNO's cash conversion factor (operating cash flow to EBITDA) has improved to 78% in FY12 from 49% in FY11. Even for the first quarter of 2013, the cash conversion factor was at a robust 136%. DNO has also been generating positive free cash flow in the last three years with FY12 free cash flow as a percentage of sales being 15.3%. In terms of leverage, DNO has a debt to equity of 0.3 and a debt to EBITDA of 0.6 as of FY12. Further, EBITDA interest coverage of 14.7 for the same period gives DNO sufficient financial flexibility for future capital expenditure programs.

Why Is The Stock Price Depressed?

Given the positive investment rationale, it is surprising to see the stock trading at cheap valuations discussed above. The point that is clear is that the valuations are not depressed because of poor earnings or sluggish operational progress.

The depressed valuation primarily comes from the absence of a final export agreement with the local government coupled with the issue of the establishment of a credible payment mechanism. Oil exports from the Tawke field in the Kurdistan region of Iraq were halted in December 2012, which resulted in no export revenue for the first quarter of 2013. Export revenues from the Tawke field were 651 million Norwegian Kronor during 4Q12.

DNO is currently selling oil in the local market, which is at a considerable discount to international oil prices. Markets are therefore discounting the current production output and future production outlook at significantly lower prices and this is impacting valuations.

The resumption of exports to international markets and a credit payment mechanism will serve as the biggest upside trigger for DNO in the future.

Probability of Payment And Export Issue Resolution

There is a high probability of resolution of the payment issue and the allowance of exports from the Kurdish region in the foreseeable future. The primary reason is the need for funding infrastructure in a war torn country. The first sign of resolution of the issue is evident from the tentative deal by Iraq and the Kurds on payment to oil companies. According to the report by Zawya -

The federal government in Baghdad and Iraq's semi-autonomous region of Kurdistan have reached a tentative agreement to resolve a dispute over payments to foreign companies that has shut down most crude oil exports from the region, Iraqi officials said. The tentative deal was reached during a meeting earlier this week between federal Prime Minister Nouri al-Maliki and the Kurdistan Regional Government Premier Nechirvan Barzani, the officials said. If the agreement comes into effect, Kurdistan could resume oil exports of nearly 250,000 barrels a day via the Baghdad-controlled export pipeline, potentially raising Iraq's oil exports to nearly 2.9 million barrels a day, from around 2.55 million barrels a day.

Besides the current issue and its movement towards a probable resolution, the presence of major oil companies in Kurdistan also points to the fact that the government is willing to allow companies to operate and export from the region. Further, exploration companies are also confident of a resolution and are therefore investing in the region.

As of December 2012, Marathon Oil (MRO) held approximately 215,000 net acres on a working interest basis in the Kurdistan Region of Iraq. In the same region, Total SA (TOT) also has 35% working interest in 2 oil blocks, in which Marathon has a stake besides the Kurdish government.

Most recently, Chevron (CVX) also signed an exploration deal with the Kurdish government to expand its oil exploration territory in the northern self-rule region.

Exxon Mobil (XOM) is also working on a gas project in Kurdistan along with the Turkey government. As Turkey has a high energy cost due to purchase of natural gas from Russia, Iran and Azerbaijan, a deal with the neighboring Kurdish government will prove more beneficial and lower the energy cost.

As mentioned earlier, major oil companies would not be willing to invest without some assurance related to payments and exports. A Bloomberg report on June 19, 2013 is an indication of the developments in the region related to the export of oil. According to the report -

Iraq's Kurds will start exporting crude by pipeline "very soon" after the completion of a new link to the Turkish border by the end of September, the Kurdistan Regional Government Natural Resources Minister said. The pipeline to Fishkabour near the frontier with Turkey, will eventually have a capacity of 1 million barrels a day by 2015, Ashti Hawrami said today at a conference in London. The semi-autonomous region in northern Iraq is "well on its way" to have enough oil to fill the line's capacity, he said.

These developments and the increasing interest of the oil majors to operate in the Kurdistan region is an indication of the point that a resolution is entirely on the cards related to exports and payments to oil companies. Going forward, a firm statement from the government can trigger significant stock price upside for DNO as the stock discounts gains from higher export prices.

I must mention here that the Tawke field is strategically located and will be one of the prime beneficiaries of any pipeline or export agreement with Turkey discussed above.

DNO Can Also Be A Potential Acquisition Target

Considering the way oil majors are looking for entry into the Kurdish region, DNO can also be a potential acquisition candidate at current valuations. DNO's assets are interesting from a M&A perspective and the Tawke asset can also be a standalone acquisition target. Any attractive acquisition bid can also trigger a major upside in the stock.

Risk Factors

The biggest risk factor for DNO is the non-resolution of the payment and export issue. However, the current stock price is depressed considering the scenario of oil sales only to local markets. It is therefore very unlikely that there will be any major downside risk from current levels.

Conclusion

DNO, with a 55% stake in the Tawke prized asset, is a grossly undervalued stock due to political issues prevailing in the region. As discussed, a resolution is very likely in the foreseeable future and DNO can see some significant stock price action. Considering a forward PE of 7.7 and a PEG ratio of 0.39, a 100% upside is very likely in the event of a resolution of the payment and export issue. The planned 2014-15 capacity of 200,000 boe per day of exports can completely change the cash flow dynamics and trigger a meaningful upside in the stock. Investors can therefore consider exposure to the multibagger at current levels.

Source: DNO International: A Grossly Undervalued Kurdish Oil Play